There are many applications and grants to own basic-go out homeowners that provide financial help, and you will qualify for all types of recommendations.Listed below are 9 software and you may grants made to help you land an effective home loan and get a location of your own so you can become a long-term citizen during the Metal State.

FHA Mortgage

S. Agencies of Property and you may Metropolitan Creativity and secures the mortgage. Using this support loan providers are protected a piece away from defense, for example they don’t sense a loss of profits for many who default towards the mortgage.These financing typically incorporate aggressive rates, smaller down money and lower settlement costs than old-fashioned finance.

You will be qualified to receive a mortgage that have a down payment only 3.5 per cent of your cost which have a credit history of 580 or more. In case your credit rating is lower than just 580, you might still meet the requirements however with a top deposit, generally speaking at least 10%.

USDA Mortgage

That it mortgage is not infamous it is provided given that a homebuyer-guidelines program through the U.S. Department from Farming. The newest catch for this particular loan is that the house have to be situated in particular rural section. Yet not, you don’t need to get a ranch otherwise result in Cedar Town is qualified. For example, the fresh FHA, the mortgage try protected through the USDA. Concurrently, there is certainly zero deposit required plus the loan money was repaired. Usually, candidates will get smooth handling that have a credit score off 640 or higher.

You could nonetheless qualify for the borrowed funds with a rating lower than 640, nevertheless financial will ask for even more paperwork regarding the percentage background.This type of financing also offers income restrictions, that may are very different of the area.

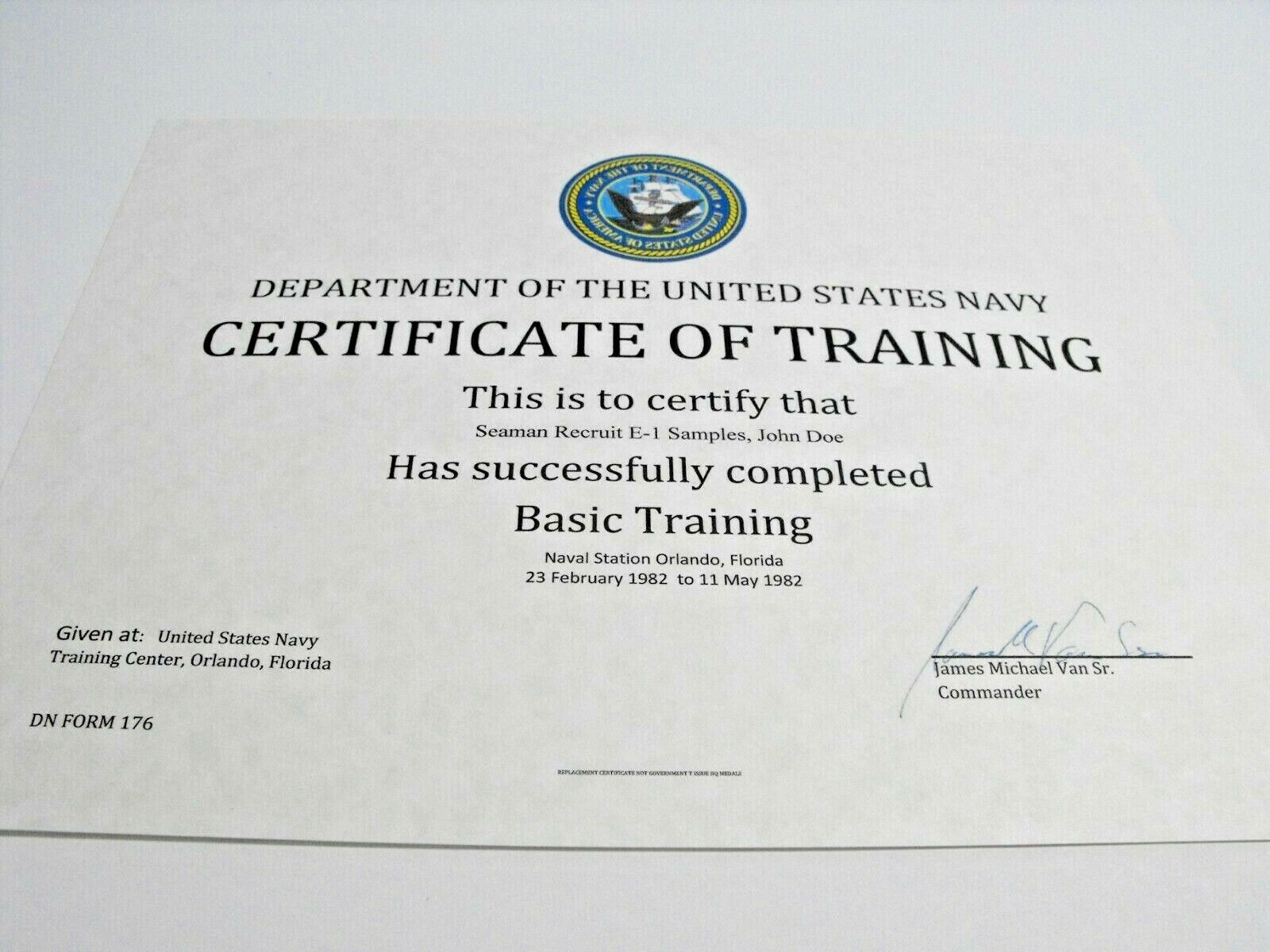

Va Financing

A great Virtual assistant financing is designed to help active-duty armed forces users, pros and you can surviving partners pick land. The fresh Veteran’s Administration claims an element of the loan, enabling loan providers provide some kind of special provides. Brand new money incorporate aggressive interest rates and want zero off percentage.

You are not necessary to pay for private mortgage insurance policies, and at least credit score is not needed to own qualifications. On top of that, whether it becomes difficult towards the resident to make payments towards the mortgage, this new Virtual assistant can negotiate on the lender for you.

Good-neighbor Next-door

This method is actually sponsored of the HUD and provides homes aid to possess cops, firefighters, disaster scientific mechanics and pre-kindergarten because of 12-degree instructors.

Federal national mortgage association otherwise Freddie Mac computer

Fannie mae and Freddie Mac computer are authorities-paid entities. It works having regional lenders to provide financial choices you to definitely benefit reduced and you will modest-money group. With these entities backing the loan, loan providers could offer competitive interest levels and take on down costs as the lower since the around title loans in SC three % of your own price.

Energy-productive Home loan

An eco-friendly financial is designed to let incorporate developments towards the where you can find ensure it is much more eco-friendly. The government supports EEM financing of the insuring all of them through the FHA otherwise Va applications.

The main benefit of this loan is that it permits brand new homebuyer to manufacture an electrical energy-effective house without the need to generate a larger down payment. The extra prices is basically folded to your number 1 loan.

FHA Area 203(k)

The new FHA Area 203(k) are a treatment program that enables a purchaser so as to shop for a fixer-upper and be able to pay the performs that should be done. This type of loan is backed by brand new FHA and you will takes into consideration the worth of the newest residence just after improvements have been made. It then lets the customer so you’re able to obtain money had a need to do the endeavor and you can boasts them within head financial. The latest advance payment for it sorts of financing is just as lowest given that step three percent.

Native Western Lead Mortgage

The new Local Western Experienced Head Financing program has aided Indigenous Western veterans and their partners buy homes to the federal believe places as 1992. The new Virtual assistant functions as the lending company. When the qualified, the customer has no making a down-payment otherwise shell out to own individual home loan insurance rates. So it earliest-time homebuyer loan now offers a 30-year fixed-speed home loan and reduced settlement costs.

Local Features and you can Applications

In addition to the apps supplied by government entities, of numerous claims and urban centers bring assist to first-go out homebuyers. You can examine with your nation’s otherwise community’s website to own guidance on property gives and you can applications found in your neighborhood otherwise get in touch with the fresh new Sam Dodd class as we remain on finest of the many these applications to you personally or local HUD-approved houses guidance agencies for more information on apps on your own city which may affect your position.

When you are looking to buy a residential property during the Cedar Area and you may want a long list of these apps excite make use of the function below and we’ll telephone call otherwise current email address your!