Financial lenders costs individuals fees to purchase will cost you it bear in running the loan and you can maintaining the features they give. Such additional charges are also designed to sometimes prompt otherwise discourage certain behaviors (i.elizabeth. loan providers will generally speaking charge a fee while late on your repayments or you pay the loan early).

It is not unusual for large finance companies so you can charges upfront costs one shelter application, payment, and you will valuation, and lingering and you may leave fees. Smaller financial institutions can also charges people, however some can offer all the way down charges or waive them to focus customers. They could supply a lot more favorable terms and conditions of release charge opposed to your four discipline.

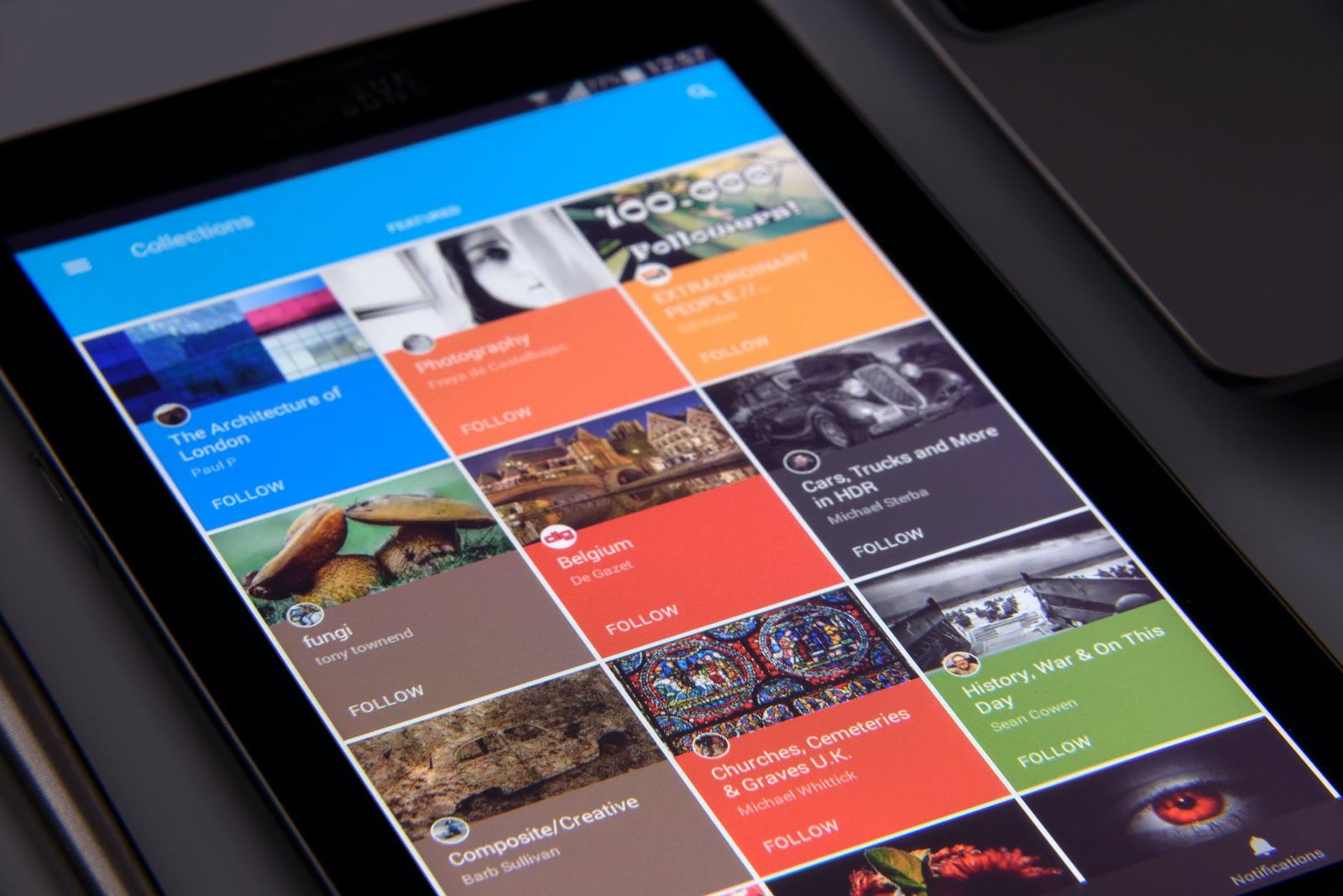

Technical and you will creativity

If you love show, benefits, and flexibility, a bank with a robust work on fintech and you will development is the most obvious possibilities. More over, provides such real-go out financing standing updates, on line cost scheduling, and simple mortgage changes always provides deeper control of their financial.

Presently, extremely banking institutions have extreme financial investments in the digital banking networks. Although not, because larger people give complete on the internet and cellular banking services, smaller and you will non-lender loan providers could be quicker into the draw in using reducing-edge technology to help you speed up procedure and supply aggressive mortgage products.

Support service and you will assistance

A major advantageous asset of borrowing from the bank regarding a giant bank is accessibility so you can an extensive department community, especially if you choose deal with-to-deal with connections. Major financial institutions supply detailed customer service courtesy cell phone, mobile, otherwise Internet. Although not, the higher amount of customers deals they match get often influence in reduced customised services otherwise expanded waiting moments.

Regional financial institutions might be able to give punctual and you will active problem resolution because of the size of their clients prior to major finance companies. Particularly, look of KPMG found customers-had banking institutions make up simply $150 million for the assets in Aussie banking, however they are the primary standard bank for over ten% of your adult population, and have now a collective five billion professionals. They enjoys 18% off full financial twigs – over 20% inside the local Australia.

Non-financial loan providers, meanwhile, promote an even more digital-centered strategy from inside the support service by way of online platforms simply because they use up all your the fresh real visibility provided by conventional finance companies.

Defense

Choosing a lender having an effective emphasis on protection can’t be exaggerated, because the delicate personal and you will economic guidance and literal dollars try inside it.

While most banking institutions pertain anti-ripoff strategies, the top Five direct with tall investments inside the technology and you will customers cover effort. This type of associations use ripoff identification expertise, biometric monitors, and you may enhanced cautions, making them finest supplied to battle frauds. Reduced competitors may also have robust actions in position, whether or not they often lack the comprehensive sourced elements of their larger colleagues.

Regulations such payment waits and you can limitations, as well as 2-foundation verification, are getting more common one of many four discipline and challenger banks the same, despite some consumers grumbling within increased rubbing.

Character and you may stability

The big Five banks’ prominence from Australia’s financial market is primarily related to its solid brand name identification and you may high level off faith among consumers.

CommBank, Westpac, NAB, and you may ANZ – and this collectively keep 75-80% of your own home loan market – could be the wade-so you can choice for of several Australians due to their long-standing visibility. He’s noticed really stable with their size, thorough regulation, and you may good money basics.

not, this doesn’t mean one most other opposition are not reliable. As they elizabeth extensive money supplies and you may broad brand identification as the new four discipline, reduced banking companies normally have strong reputations in their regional organizations to possess customer-centric procedures.

Every Maine title and loan authorised deposit-getting institutions (ADIs) particularly financial institutions, credit unions, and several on the web loan providers is actually greatly controlled and you may hold a similar defenses and you may coverage from the Financial States Design (FCS), hence claims places as much as $250,000 each account. This does not shelter low-banking institutions.