Download Your property Market Money Book

At Markets Financial Selection (MFS), i run each other brokers and you will direct customers. You’ll find nothing stopping you, since the an investor, seeking out your own funds getting public auction characteristics. However,, there are many benefits of working with a broker.

Essentially, a market money representative facilitate borrowers inside the getting quick-name funds to bridge brand new gap anywhere between possessions purchases. To have investment from the public auction, this may without a doubt encompass attaining funds quickly to pay for get for the tight timeframes involved.

Market money brokers work to recognize the most likely alternative for the specific facts. They will certainly together with seek the best terms and conditions possible. This is when working with a broker can get prove of good use given that generally, they usually have depending-into the relationships having specific lenders. These types of matchmaking get let them get access to helpful products and you may rates which may not be available to lead individuals.

Agents, specifically those handling public auction financing, may be able to give a quick techniques. They are able to save time by doing much of new legwork on your behalf. Considering the knowledge of the field, they’ll be able to handle most of the necessary files fast.

When you are agents can prove useful, you need to think about any possible cons. By way of example, while you are agents could have accessibility a wider range of products, they may merely manage a restricted amount of loan providers. They could in addition to charge additional fees which will look into your funds.

Fundamentally, try to determine if handling a public auction funds agent is useful for your issues. If you’re unsure from how to proceed, you might watch out for brokers who’ve certain certification or accreditations to their name, particularly: CeMAP (Certificate inside Mortgage Information and exercise), an enthusiastic NACFB (National Relationship out of https://cashadvanceamerica.net/title-loans-ut/ Commercial Money Agents) registration, or even the Official Specialist within the Specialist Possessions Financing (CPSP) qualification.

Market financing loan providers & how to recognise a good one

While wanting to know just how to acknowledge a beneficial auction fund lender of a detrimental one to, you ought to pick in the event the its properties line up on the auction planet’s demands. We believe a lender that provides freedom, speed, and you may adaptive requirements was primed to keep up with the latest putting in a bid.

From the Market Financial Choices (MFS), our company is versatile across every facet of our team. Our company is prepared to lend on the a general a number of possessions types, urban centers, and situations. We all know how even the most run down possessions available at public auction you will nonetheless keep window of opportunity for investors.

And no count where you due to the fact a trader come from, or exactly how the record might look, we’ll circulate easily to provide you with the fresh new capital you desire. Even if you enjoys overlooked costs, CCJs, or overseas difficulty on your own checklist, we might manage to present financial support in just days.

Who i lover having

At the Markets Monetary Solutions (MFS), our very own public auction funds may be used any kind of time public auction family. This may involve the larger, well-recognized homes until the reduced players. Across the The united kingdomt and you can Wales, you will find more 31 public auction domiciles. These house specialise in specific places, although some provide national coverage.

There will additionally be certain auction properties you to specialize of the property style of. Specific might only record attributes, such as.

Each public auction household will receive its very own operational laws, and you may charge for both consumers and you may manufacturers equivalent. Since there is a rule of thumb having an effective ten% put expected on the day, this might vary depending on the market domestic therefore create have a look at in advance. There may even be customer’s fees, a consumer’s superior, and other price charges. Try to ensure that your auction house fund fits when you look at the given this.

Industrial Auction Loans

We can easily work with overseas dealers just as effortlessly because we are able to with domestic people. In the procedure, you will see a faithful Markets Monetary Alternatives (MFS) underwriter who will be easily accessible, but delight take into consideration people applicable big date variations.

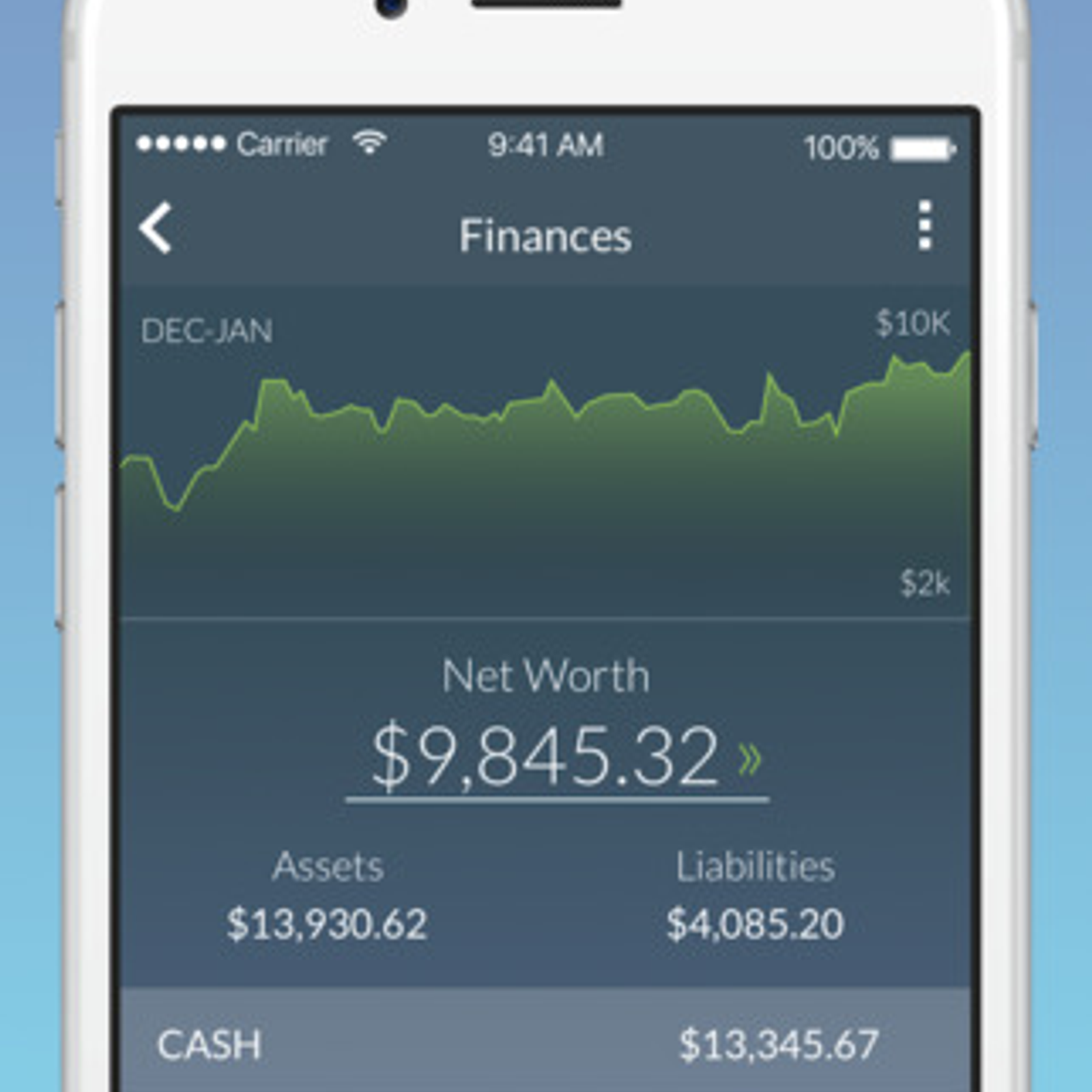

Entering a market with out resource shielded you may establish threats. Without knowing how much cash investment is accessible for you, you might be susceptible to going beyond your budget. As well, you may want to lose out on tons if you find yourself also hesitant to quote for the, due to not knowing the maximum restriction.

Are foreclosure public auction financial support one other?

Together with, while you may anxiety that all the necessary due diligence you may slow down the bargain, all this shall be complete within this 3 days whenever we discover what we you prefer easily.