People prevent entering belongings of one’s own as they don’t want to shell out mortgage insurance, however it is vital that you remember that this type of payments can be a beneficial path to much time-label wealth manufacturing.

If you have a great $a dozen,250 down payment and you will a loan worth $350,000, you should have an enthusiastic LTV regarding 96.5%, and you will probably definitely need to pay financial insurance rates. If it insurance costs step 1% of your loan’s worth from year to year, it is possible to shell out $step 3,five hundred on top of the normal homeloan payment.

Since you create repayments, your own LTV tend to disappear plus household really worth will increase – and will boost from the considerably.

Remaining some thing traditional, let’s say your brand new home’s really worth expands from the 5% every year for the next 5 years. At that time, your residence might be well worth nearly $450,000! At the same time, your payments manage reduce your dominating. You might has doing $100,000 in collateral, even though you shell out a whole $17,five-hundred when you look at the home loan insurance rates.

That’s a rise in your own net worth of $82,500! And when the market stays it very hot, you stand to gain alot more.

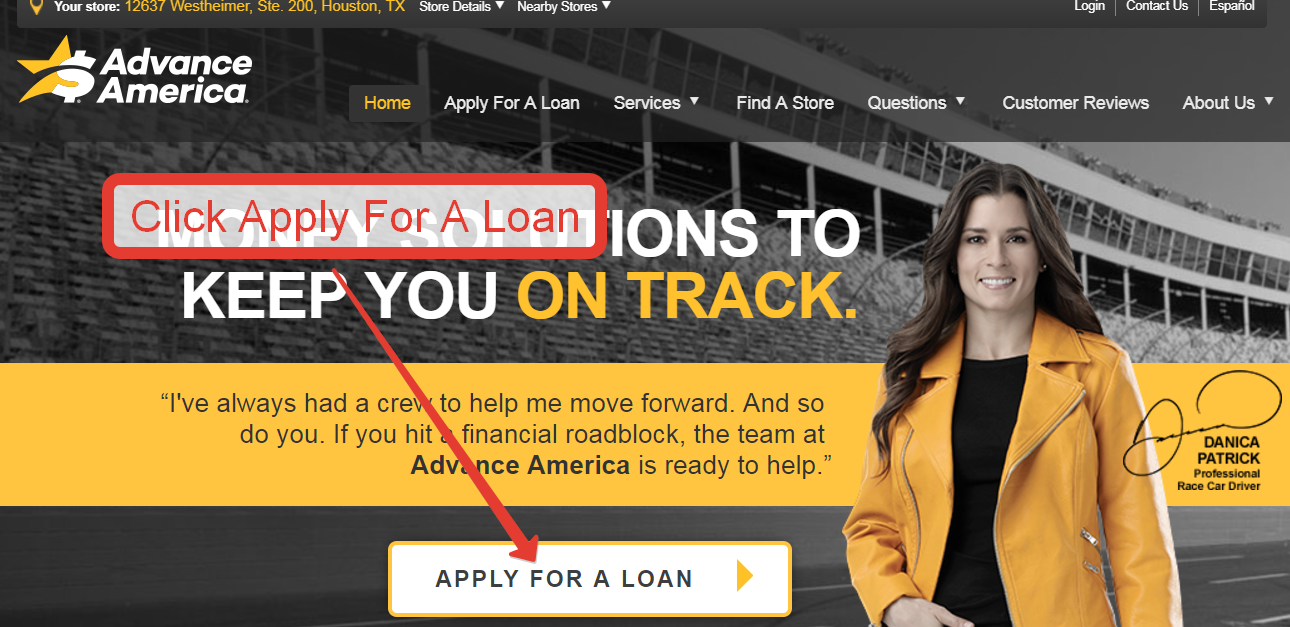

Talk to financing Administrator now

For more information about how exactly your options could open when it is prepared unsecured personal loans Eagle to spend mortgage insurance rates, i prompt you to receive in contact with one of our friendly Loan Officials. They’re able to look at your deals to own a down payment, tell you about down payment guidance for sale in your neighborhood, that assist you are aware most of the potential will set you back and benefits.

Financial insurance facilitate protect lenders out of individuals that simply don’t make their home loan repayments. You may have to pay the advanced if you have an effective quick down-payment otherwise rating a national-recognized mortgage, you could plus find ways to stop (or cure) the insurance superior.

In this post:

- What exactly is Home loan Insurance coverage?

- Particular Home loan Insurance policies

- What does Home loan Insurance Rates?

- How to prevent Mortgage Insurance rates

Home loan insurance rates assists include lenders off losses in the event the borrowers end and work out mortgage repayments. You are required to buy mortgage insurance rates or similar products out-of coverage when you get certain authorities-recognized mortgages otherwise a normal home loan that have less than a 20% downpayment. In addition, you will probably require (and will be required to purchase) home insurance, hence handles you if some thing goes wrong with your house.

What’s Home loan Insurance coverage?

Home loan insurance coverage restriction lenders’ risk, for this reason , its simpler to qualify for a home loan which have home loan insurance policies. Generally, homebuyers whom pay money for home loan insurance rates generally have lower credit scores and better mortgage-to-worthy of (LTV) and you can loans-to-income (DTI) rates than just individuals just who score old-fashioned mortgage loans rather than insurance policies. Nevertheless they is very first-big date homebuyers.

Although the rules include lenders (not you), you’ll have to pay the superior. There could be an initial insurance prices that is added to your own most other settlement costs or rolling with the mortgage. Together with, you are able to pay a monthly fee and is part of your month-to-month mortgage payments.

Whether or not you ought to get mortgage insurance hinges on their down payment while the version of mortgage. No matter if avoiding the extra expense can be preferential, you will find positives and negatives.

Gurus away from Home loan Insurance policies

- You can buy a home with less overall down. If you don’t have enough coupons to own a good 20% deposit, you can qualify for a conventional home loan with a smaller off percentage and you may mortgage insurance rates.

- It offers a lot more choices. You’re able to pick a wider listing of house for people who imagine various other combinations of financial products, home loan numbers and you will insurance rates conditions.