Lender allegiance can be backfire or even check around observe when the there are better cost, says Heather McRae, an elderly financing administrator on Chi town Financial Functions. Which is particularly so in the present refi markets, where lenders is aggressively contending to woo users.

Predicated on a black Knight declaration, financial preservation is at a the majority of-day lower. Home loan servicers (read: the business that gathers the mortgage payment) chose simply 18% of your own estimated dos.8 million home owners which refinanced regarding the last quarter away from 2020, a decreased show to the listing.

Pro: It’s also possible to snag a much better home loan rates

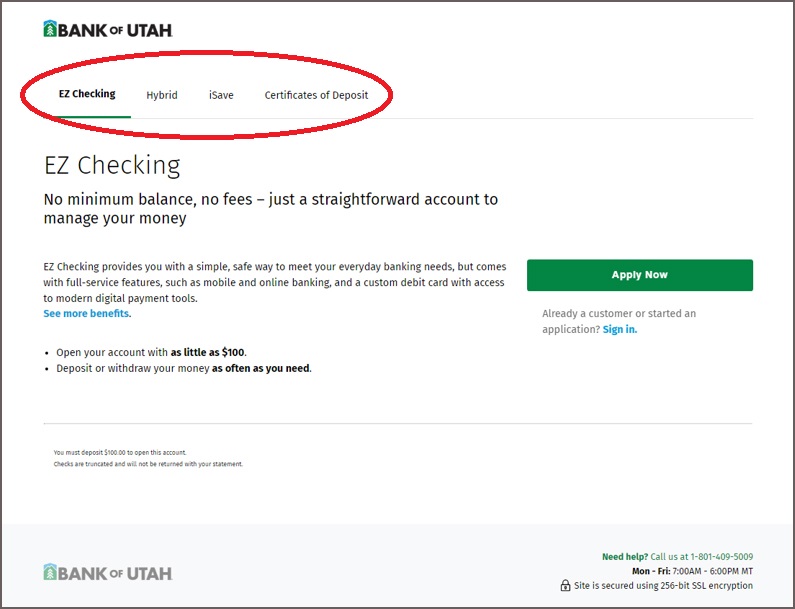

It never hurts to search as much as, says Dave Mele, chairman out-of House. A number of individuals stick with the financial when refinancing given that they’ve been always all of them, you usually should examine prices to make sure you’re getting the lowest price, says Mele. In case your membership is during a good condition, you are able to find a minimal refi rate with your existing lender, however, other loan providers keeps different financing conditions.

Although not, you don’t have to keep in touch with the lender around. McRae ways taking quotes of around three lenders when surveying your options. We spoke to help you [a great refinancer] has just just who talked to eleven additional lenders in fact it is merely entirely a lot of, she states. You’re not going to get considerably additional also provides when you go to a ton of lenders.

If the most recent mortgage servicer facts home loan refis (some you should never), McRae suggests providing a bid from their store – but be prepared to provide proper bunch away from documentation. People wrongly faith the application form process is easier once they stick to their financing servicer, in standard you will need to supply the same suggestions and you can documentation towards the servicer that you would in order to good the fresh new lender, she claims.

Con: That you don’t know how a unique lender treats its customers

If you have set-up a good reference to the lender, that’s zero brief point. Which have some one you believe with your cash is priceless, along with your house is probably the premier investment you’ve got, so you want to make sure to trust the bank you are working with, states Todd Sheinin, chief performing manager at the Homespire Financial from inside the Gaithersburg, Maryland. Specific loan providers reduce their clients better than anybody else.

Think on your own expertise in your financial. Sheinin advises offered inquiries such as for instance: Was indeed your left informed of everything which had been going on along with your home loan? Would you feel you’d your loan officer’s full attract? Do you get a good speed? Has actually their financial kept in contact?

With a lender which is receptive is very essential if you want to modify your financing. Instance, when you are trying to get home loan forbearance through the CARES Work, telecommunications and you may visibility from your own lender was critical in assisting your prevent foreclosures.

Pro: You can get all the way down settlement costs

Closing charge to have refinancing normally cost dos% so you’re able to 5% of the fresh new loan amount – toward good $3 hundred,000 balance, which is $6,000 to $15,000, because particular loan providers costs highest charge for domestic appraisals, term online searches, or other qualities. Ergo, a separate lender can offer your straight down settlement costs than their completely new financial.

That being said, certain loan providers will be happy to give a recent and you may a consumer an excellent discount to your closing costs to ensure that they’re as the a customer, Sheinin online installment loans Washington says. According to the financial, they could promote a reduced total of just a few hundred cash so you can on the $step 1,000 in the lower closure costs.

You to caveat: I give individuals to be careful whenever a lender even offers a good credit’ to pay for specific or all closing costs, McRae says. One almost always form a lowered interest rate is actually offered.

Con: You could get slapped that have an excellent prepayment penalty

Even though prepayment charges are very less common, specific loan providers still charge consumers a fee for investing its financial of in advance of the financing identity finishes. Prepayment punishment will set you back may vary commonly. Particular loan providers costs people a share (always dos% to three%) of the a great principal, while some estimate prepayment charges based on how much appeal the new debtor manage shell out on their financing getting a certain number of months (typically 6 months).

Select the phrase prepayment disclosure in your home loan agreement to find out if your lender costs a good prepayment punishment and you can, if that’s the case, exactly how much it will set you back.

The bottom line

You aren’t required to re-finance with your totally new lender, however, whether it is reasonable to change to another you to definitely depends on your own goals together with what speed and you will conditions you could qualify for with a new lender. You would like a little let whittling down the choices? Here are a few Money’s range of Top Mortgage Refinance Businesses from 2023.